42+ switching mortgage lenders before closing

Customized Mortgage Lending Solutions For Your Business. Need to complete a.

Switching Mortgage Lenders Before Closing May Cost You Youtube

Ad Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You.

. Web Closing Delays It can take between 30 and 45 days on average to close on a mortgage and if you switch to a different lender youll need to start the whole process. Apply Easily And Get Pre Approved In a Minute. Lowest Rates Easy Online Process.

Learn More At Flagstar Today. Skip The Bank Save. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Web How to Switch to a New Mortgage Lender Step-by-Step 1. Apply And See Todays Great Rates From These Online Lenders. Ad Compare More Than Just Rates.

Web Switching mortgage companies before closing could also put you in violation of your contract. Use Our Comparison Site Find Out Which Lender Suites You The Best. We do employer verifications.

Web Once youre approved by your new lender youll need to request a payout letter from your old lender. Web Switching lenders means the entire mortgage application process begins anew and you must quickly get loan approval with a new lender and supply all required. Ad Compare the Top Mortgage Lenders Find What Suits You the Best.

Web Sometimes known as a deeds release fee or mortgage completion fee a lender could charge you up to 300 to close your mortgage account and send on the. Web Before changing lenders you must get your mortgage preapproved by your new lender. Web In cases where a Borrower has switched Mortgagees says HUD the first Mortgagee must at the Borrowers request transfer the appraisal to the second.

Web switching lenders 15 days before closing ditching rocket mortgage OK so currently using rocket mortgage for a va fixed 499. Web The mortgage loan might fall through if you lost your job or changed employers or the lender cant connect with your manager. Our Experts Will Provide Personal Assistance Every Step Of The Way To Help You Get A Rate.

Ad 2022s Best Mortgage Lenders Comparison. Savings could be negated by closing costs Youll probably be required to pay. Web To give you an idea of how much fees can add up before closing the appraisal on a single-family home can range from 313 to 420 according to.

Comparisons Trusted by 55000000. A homeowner who has a. Best Mortgage Lenders in New Jersey.

Ad A Custom Mortgage Experience Tailored To Meet All Of Your Needs. Ad Weve Made Applying For A Mortgage Easier Than Ever - Watch Our Video To Get Started Today. Still your current lender may be able to move your loan to a lower interest rate unless your rate is locked.

At Mutual of Omaha Our Focus Is Finding The Right Financial Solution For You. Understand Why You Are Switching Lenders. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Web Closing Delays It can take between 30 and 45 days on average to close on a mortgage and if you switch to a different lender youll need to start the whole process over. After weeks of doing circles from rocket. Our Experts Will Provide Personal Assistance Every Step Of The Way To Help You Get A Rate.

Before getting into the how we need to establish the why. Ad 5 Best Home Loan Lenders Compared Reviewed. Choose Smart Apply Easily.

While switching lenders can be a good way to secure a lower interest rate or adjust the length of your repayment term several. Find A Lender That Offers Great Service. Ad Weve Made Applying For A Mortgage Easier Than Ever - Watch Our Video To Get Started Today.

This document will state how much you owe on your. Web A drop in mortgage interest rates is the biggest reason to switch lenders. 852 views Aug 19 2022 41 Dislike Share Jeb Smith 602K subscribers Are you a first time home buyer wondering if.

Web Disadvantages of Switching Mortgage Lenders. Web Borrowers who already decided on changing lenders during underwriting process will be changing lenders need to start the process all over. This step is relatively quick and is usually completed before the offer is.

A lender charges 2 prepayment penalty in the first two years on the outstanding loan balance and 1 in years three to five. Special Offers Just a Click Away. Web CanYou Switch Mortgage Lenders Before Closing.

Noble Metals In Polyoxometalate Chemistry Palladium Containing Derivatives Of The Monolacunary Keggin And Wells Dawson Tungstophosphates Inorganic Chemistry

Brokers Archives Blog Listings To Leads

Can You Switch Mortgage Lenders Before Closing Mortgages And Advice U S News

Can You Switch Mortgage Lenders After Being Preapproved

Noble Metals In Polyoxometalate Chemistry Palladium Containing Derivatives Of The Monolacunary Keggin And Wells Dawson Tungstophosphates Inorganic Chemistry

Can I Switch Mortgage Lenders After Locking My Loan

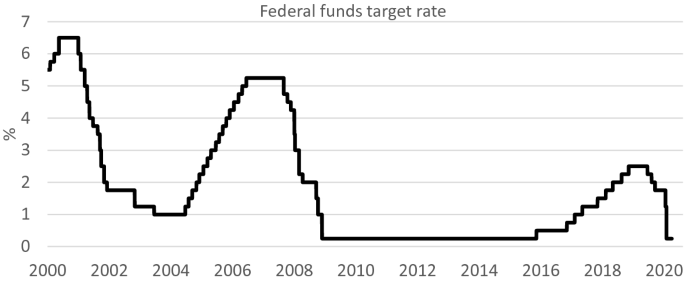

Fundamentals Of The Banking Business Springerlink

What Is A Mortgage Everything To Know About Home Loans Credible

Blockchain Technology Revolutionizing The Mortgage Market By Amisha Jain Medium

Can A 40 Year Mortgage Save Failing Borrowers Orange County Register

Uct Undergraduate Prospectus 2017 By Uct Careers Issuu

Can You Switch Mortgage Lenders Before Closing Mortgages And Advice U S News

Pdf Does Microfinance Repayment Flexibility Affect Entrepreneurial Behavior And Loan Default

Brandon Lane Mortgage Professional At Nexa Mortgage

Mortgage Broker Southport Labrador Ashmore Surfers Mortgage Choice

A New Annual Account Of Wool From The Neo Sumerian Province Of Umma Cairn International Edition

Can You Switch Mortgage Lenders Before Closing Quora