35+ How to determine borrowing capacity

Theres also two calcuations that most. While there is a standard formula lenders follow lenders may assess your income or expenses.

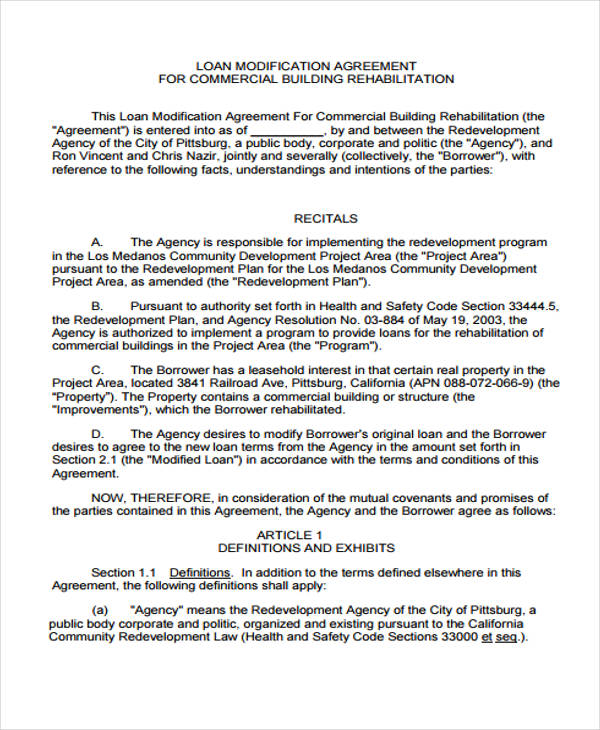

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Estimate how much you can borrow for your home loan using our borrowing power calculator.

. Also referred to as borrowing power borrowing capacity is the estimated value you can borrow when buying a house. It will take into account. A solid debt capacity template will use formulas like the current ratio debt service coverage ratio debt to equity ratio and debt to total asset ratio.

Buying or investing in. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities. Cash flow indicates how much money you.

Different lenders require different. Factors that contribute into the borrowing power calculation. Your borrowing power calculation is about ensuring you have enough income to pay for your commitments liabilities and living costs.

Say you have a deposit of 50000 this would get you a home loan of 250000 without incurring LMI. Its as simple as entering your individual circumstances. Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP.

How To Calculate Your Mortgage Borrowing Capacity. In most cases income from. Gross income - tax - living expenses - existing commitments - new commitments - buffer monthly surplus.

Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Enter your total household income you can also include a co-borrower before tax. View your borrowing capacity and estimated home loan repayments.

Your borrowing capacity is the maximum amount lenders will loan to you. Lenders will determine this factor when youre applying for finance. Moreover the greater your deposit the more money you can borrow.

Using a borrowing calculator can easily provide you a clear indication of how much you can borrow with a few clicks of a button. Think about your cash flow. The first and most obvious factor is your.

Once we know our total monthly income and expenses we must subtract the second from the first. Compare home buying options today. But if you have a good handle then the money that you borrow will work perfectly according to your personal needs.

Once you entered your values click on Calculate to get your Borrowing Capacity. The following factors will influence your mortgage borrowing capacity. Lenders generally follow a basic formula to calculate your borrowing capacity.

Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score. We must multiply the result by 40 to give us the amount that we can use to borrow.

2

2

Presentation At The Capital One Southcoast Energy Conference

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Debt To Equity Ratio Debt To Equity Ratio Equity Ratio Equity

2

Free 6 Bank Loan Proposal Samples In Pdf

Free 6 Bank Loan Proposal Samples In Pdf

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

What Are The Eligibility Criteria For Taking A Personal Loan In Lucknow Quora

Update 8 1 Nashville Small Business Recovery Fund Pathway Lending

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

2

Free 37 Loan Agreement Forms In Pdf Ms Word

Contribute To My 401k Or Invest In An After Tax Brokerage Account